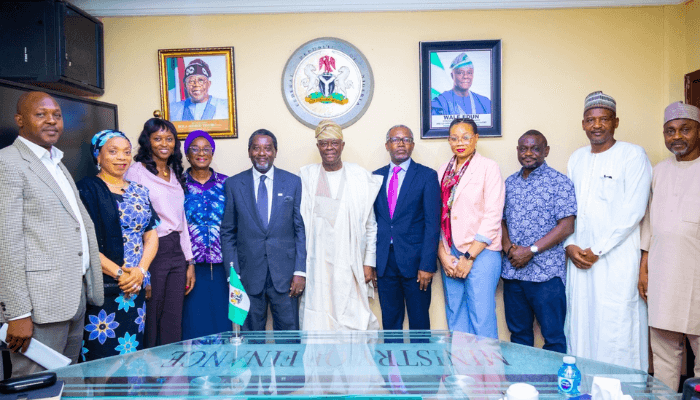

The Nigerian-British Chamber of Commerce (NBCC) has intensified its policy advocacy efforts following a strategic engagement with the Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, in Abuja.

The visit, led by NBCC President and Chairman of Council, Prince Abimbola Olashore, forms part of the Chamber’s renewed drive to strengthen public–private sector collaboration, deepen UK–Nigeria trade and investment relations, and address regulatory challenges affecting its members.

During the meeting, Olashore reaffirmed NBCC’s role as a key bridge between the business community and government, while expressing the Chamber’s support for ongoing fiscal and structural reforms aimed at enhancing Nigeria’s competitiveness and boosting investor confidence.

“The NBCC remains committed to strengthening the bridge between business and policy. We appreciate the Honourable Minister’s openness to partnership and constructive dialogue,” Olashore stated.

In his response, Minister Edun commended the Chamber’s proactive engagement and reiterated the Federal Government’s commitment to creating a stable and predictable macroeconomic environment that supports private-sector-led growth.

He noted that current fiscal reforms are focused on revenue stabilisation, improved efficiency, and targeted support for sectors with strong export potential.

Discussions during the meeting explored areas of potential collaboration, including joint investment promotion initiatives, support for small and medium-sized enterprises (SMEs), tax policy reforms, and the co-hosting of stakeholder forums to ensure continuous feedback between policymakers and the private sector.

Minister Edun also encouraged the NBCC to continue providing data-driven policy recommendations to inform government decision-making on fiscal and trade-related matters.

The engagement concluded with a mutual commitment to institutionalise sustained dialogue between the Chamber and the Ministry, reinforcing collaboration on policies critical to Nigeria’s economic recovery and long-term investor confidence.